“I really like those guys. They don’t have the personality of movie executives.” Director Sofia Coppola on A24

A24 is building a new kind of movie studio.

The indie studio behind critically acclaimed films Moonlight, Uncut Gems, and Everything Everywhere All at Once has built a cult-like following thanks to its consistent delivery of auteur films that don’t feel like typical big budget Hollywood pictures. They’ve built the sort of enviable reputation where fans will buy tickets without even seeing a trailer — just because it’s A24.

But A24’s recent fundraise at a $3.5 billion valuation raised some eyebrows. How does a small, albeit successful, art-house film studio justify a multibillion dollar valuation? Behind that is apprehension: Will A24 pivot from the indie films that built its fanbase to mass-appeal blockbusters to live up to its unicorn status?

Let’s put the $3.5 billion valuation into context. Variety and The Information estimate A24’s 2023/24 annual revenue in the range of $200-$300 million. Microcap reported the following 2024 multiples for public companies in motion picture and film production:

Revenue Multiple: 0.8

EBITDA Multiple: 6.1x

If we assume A24 has top of the industry margins (25%) and revenue at the top of industry estimates ($300M) then they’d have an EBITDA of $75M, and an optimistic valuation somewhere in the range of…. $240 — $458 million.

Revenue Multiple: $300M x .8 = $240 million valuation

EBITDA Multiple: $75M x 6.1 = $458 million valuation

Quite a lot lower than $3.5 billion. However, A24 holds the status of a prestige brand capable of commanding large audiences. We can look at the valuation of a similar studio to get a better sense of A24’s value. Reese Witherspoon’s Hello Sunshine sold to Blackstone-backed Candle Media for $900M in 2021 at a 10–12X EBITDA multiple. Like A24, Hello Sunshine has critically acclaimed franchises, a distinctive brand, and deals with multiple streaming services.

Applying Hello Sunshine’s 12X multiple to A24 yields a (closer) valuation of $900M.

EBITDA Multiple: $75M (EBITDA) x 12 = $900 million valuation

Closer, but in order to get to $3.5 billion, A24 would need an EBITDA multiple of 46.67x instead of an already generous 12x. This suggests that A24 does plan to expand its business model to reach its multi-billion dollar status. The simplest theory is that A24 will dive headfirst into mass-appeal hits, losing their brand of auteur movies in the process.

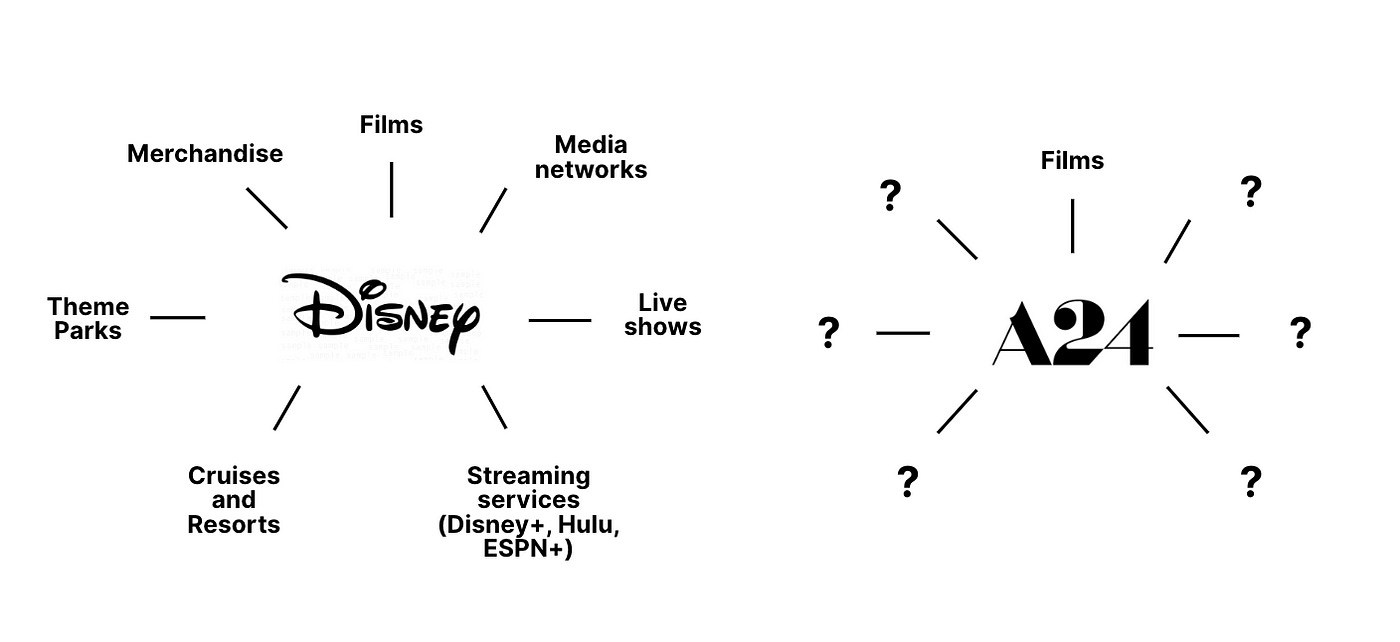

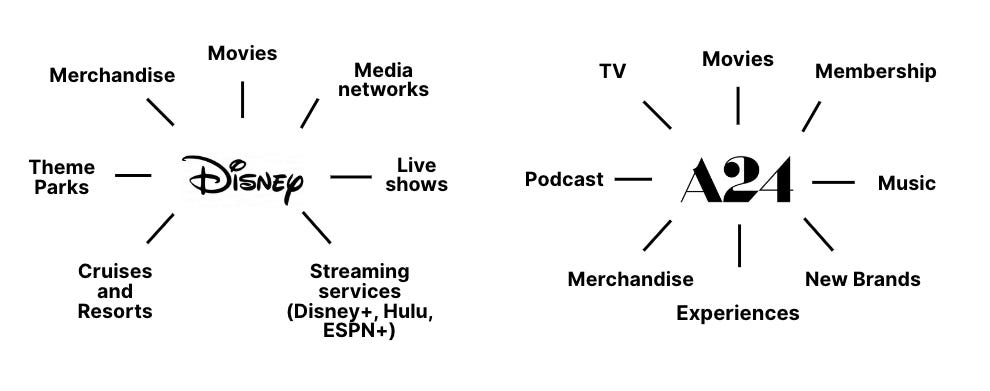

But, that would be selling the studio short. A24’s founders created the brand to offer films with a ‘distinct point of view’ (FastCompany). Their plan is not to sell out into mass-appeal blockbusters. Rather, A24 has a more profitable plan in mind: turn A24 into a platform with multiple businesses under the A24 umbrella. Think Disney’s diversified model of parks, games, merchandise and movies, but instead of heartfelt children’s stories at the center, this is a brand built on standout, auteur storytelling.

A24 is already pursuing a platform strategy. In this Diary of a Brand, I’ll go over the plans A24 is laying to shift the itself from cult-studio to cult-platform, beginning with the history of A24, and how other brands can follow suit.

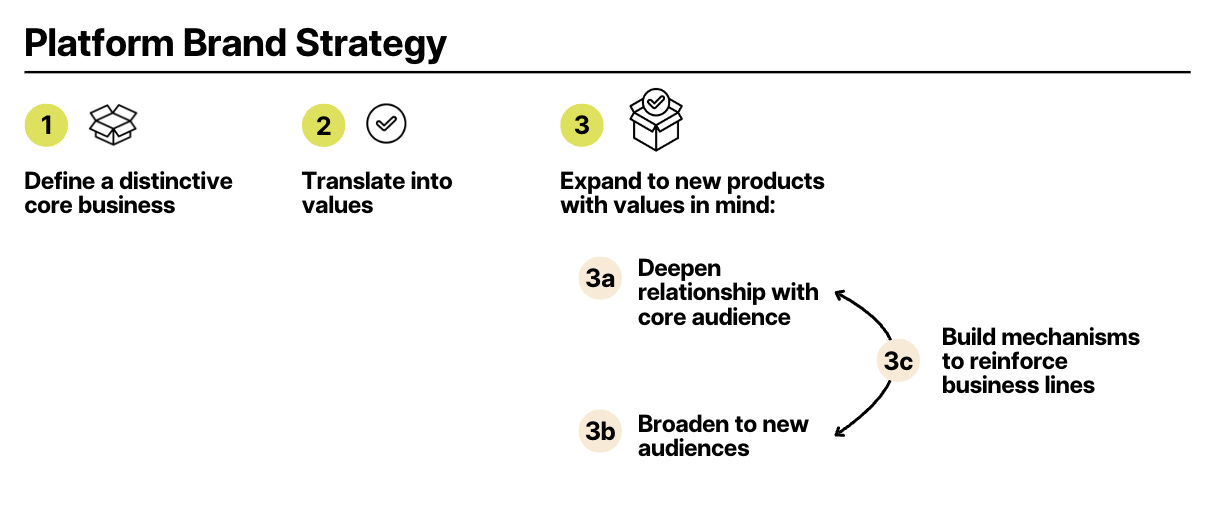

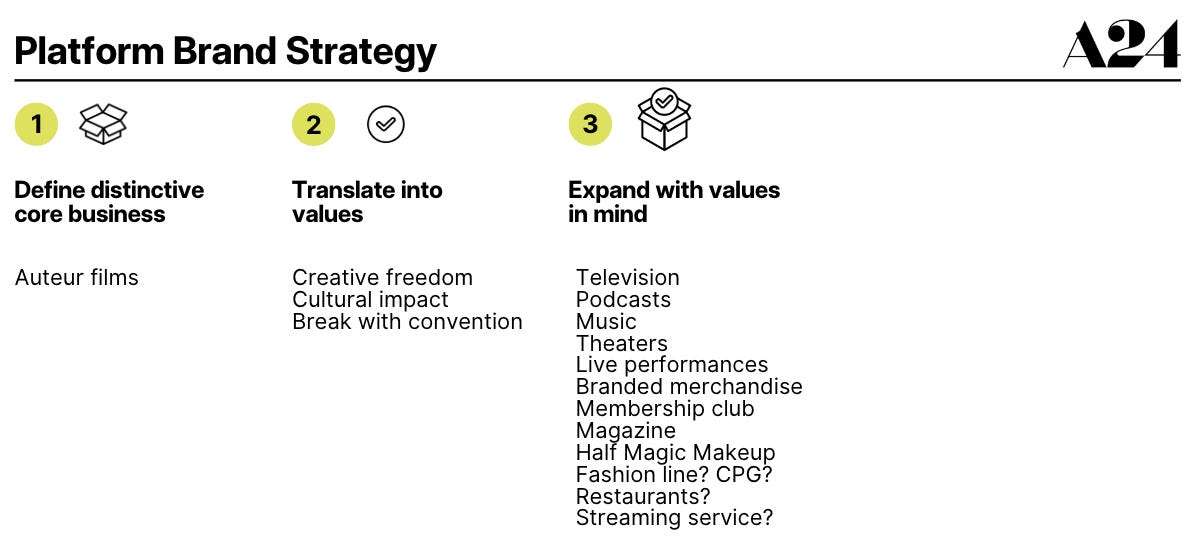

There are three steps to building a platform brand. A24 is already well into Step 3.

Step 1 of building a platform brand: Define a distinctive core business

Film industry veterans Daniel Katz, David Fenkel, and John Hodges founded A24 in 2012 with a thesis that audiences would be willing to pay for films that offered something different. Rather than appealing to everyone, their plan was to inject creativity back into film by returning decision making to the filmmakers:

There’s all these really, really smart, capable, ambitious people that love movies. And they were like the third guy at the company. No one had a voice. I felt like there was a huge opportunity to create something where the talented people could be talented. — Daniel Katz, GQ, 2017

A24 offers wide creative freedom to their filmmaker partners — resulting in a reputation for the unconventional. Their highly engaged audience is then enough to ensure a tidy profit for their films, which average between $15 million and $20 million to produce. (The Observer).

Part of the A24 business model involves keeping costs low.

A24 does this in two ways. The first is talent. The studio’s reputation for giving filmmakers significant creative freedom is a draw for established and emerging talent who are willing to work for lower upfront fees in exchange for artistic autonomy and the opportunity to tell bold, career-defining stories. Their resulting movies reinforce A24’s reputation, which in turn attracts more talent.

Most filmmakers have had bad experiences in the past where you do all the hard work, and then these guys in slick suits come along and they’re like, “We know what we’re doing now! We’ll handle it!” … I felt with [A24] it was a dialogue. I felt like we were all on the same team. — Asif Kapadia, Directed A24’s ‘Amy’

The second way A24 keeps costs low is marketing. Instead of major campaigns around their films, A24 has had consistent success driving online virality — turning their fans into media for them.

“Unlike most studios, A24 does not rely on television ads to sell a movie... Instead the company has mastered the art of finding a specific audience online and convincing them — through online and clever social media content for instance — to evangelize for them.” — NYTimes, 2023

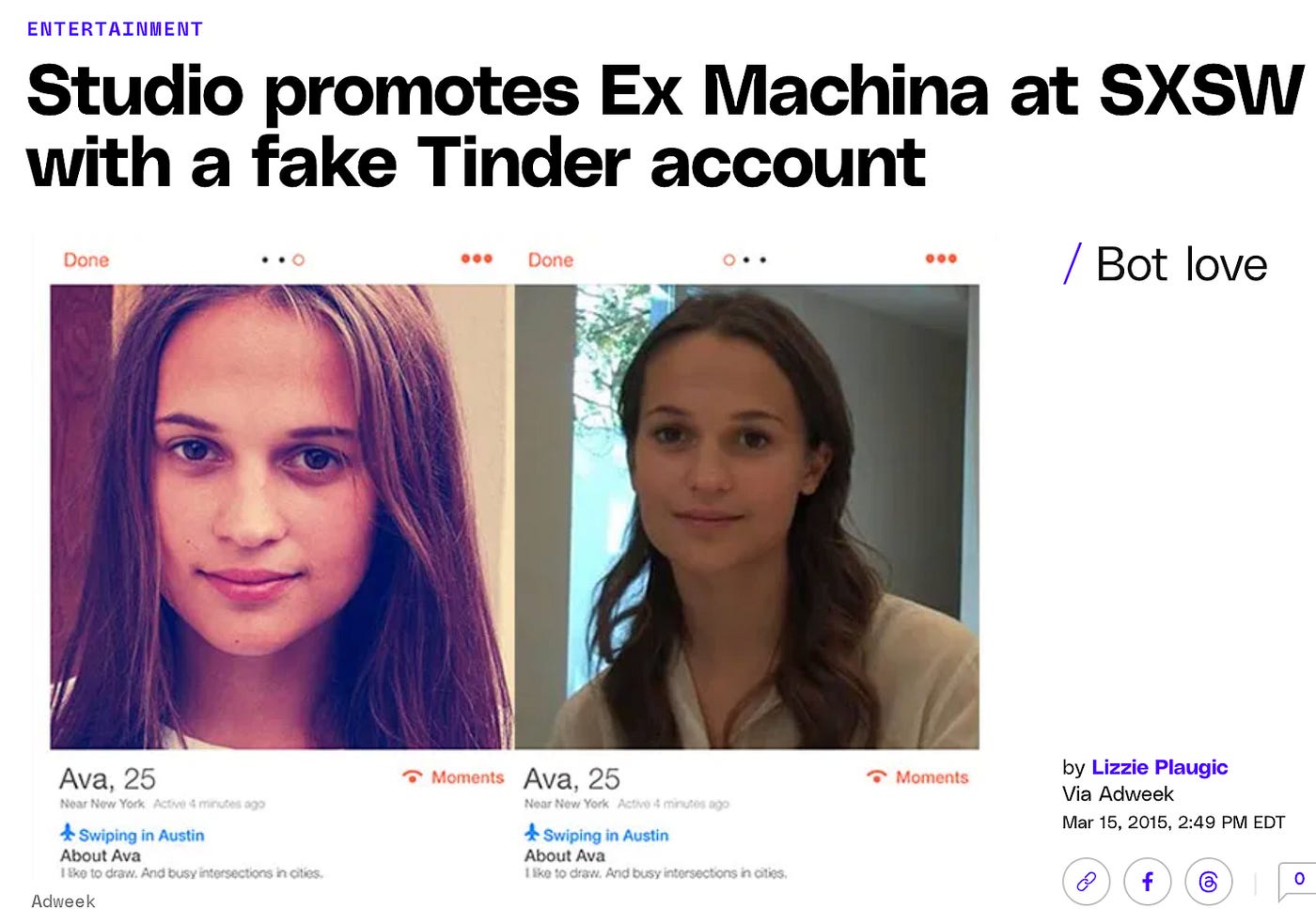

For example, when marketing 2015’s Ex Machina at the SXSW film and media festival, A24 created a fake Tinder account for the AI robot, Ava. The account interacted with SXSW attendees (presumably film buffs) before sending them a link to the film’s Instagram account. The story caught fire — driving press and virality for the film.

When marketing 2018’s horror hit Hereditary, the A24 team sent packages of creepy dolls to viewers right after seeing a midnight screening of Hereditary — as in, when viewers are still a bit spooked — driving a wave of online discourse from attendees and film critics.

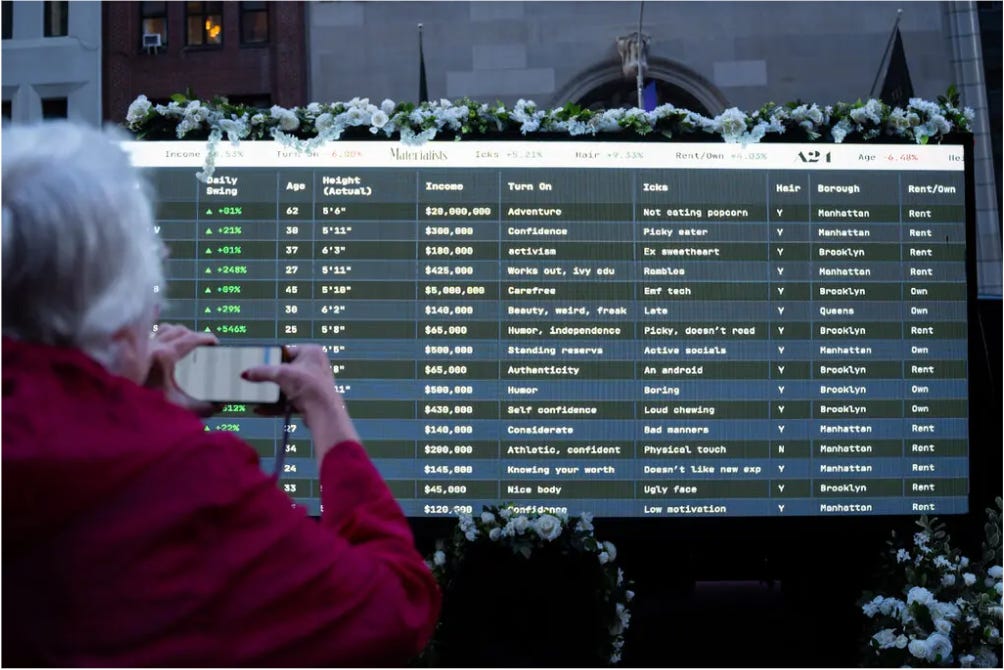

And for 2025’s Materialists, a romantic comedy centered on a high-end matchmaker who sees her clients for their market value, the A24 team partnered with the New York Stock Exchange to create a website where men could enter their stats (such as Height, Real Estate, Income) and the site would spit out a ‘market value’ for the user. Again, the site went viral.

Part of A24’s ability to go viral may be that their culture of creative freedom expands past filmmakers and to the A24 marketing team. Alicia Vikander, who plays Ava in Ex Machina, was not even aware of the Tinder campaign until she read about her photo being used to catfish SXSW attendees.

“I think the operating principle was, ‘Don’t ask for permission. Ask for forgiveness.’ I think it just showed that we cared about these movies so much.” — Zoe Beyer, Marketing Lead, A24, GQ

If Ex Machina had been distributed by a big studio — this isn’t actually a criticism of studios; it’s actually just a statement of fact — the film would not have been remotely as well received or successful as it was. — Alex Garland, Director, Ex Machina, GQ

This habit of ask-for-permission-later marketing even carries over to A24’s development side. When A24 executives were pitching for the distribution rights to their first hit, Spring Breakers, they sent their Head of Acquisitions to meet Spring Breakers’ producer with a set of custom glass bongs, a reference to the film’s content, to show why A24, an unproven studio, would take more care to market their film than a larger studio:

“So everyone’s wrapping up this gift basket that I’m supposed to deliver and say, ‘This is why you should go with us. We’re passionate. We get movies.’ And the only thing we could put it in was a cardboard box with duct tape. So I’m showing up to the airport with no luggage and a cardboard box with duct tape wrapped around it… the guy asked me, ‘Is there anything we might find suspicious in there?” I said, “There’s an art piece inside in the shape of a gun.’ And literally the entire security department was like, ‘What is wrong with you?’ Long story short, it made it through.” — Noah Sacco, A24 Head of Acquisitions,

If that doesn’t convince a producer that you will go to the ends to market her film, what will?

A24 has also rethought trailers.

Instead of asking viewers to sit through a 30 to 90 second mashup of a movie (which potentially gives away the film), A24 markets through GIFs and short clips that give very little away, but manage to capture fleeting attention on social media. Their social team pulls out shareable and ‘what is this about’ aspects of films and turns them into short clips which drive intrigue and conversation.

A24’s understanding of digital content has turned the studio into a brand of its own; A24 has 3x the Instagram followers of Paramount Pictures — despite the latter having a public market cap of $8.5 Billion.

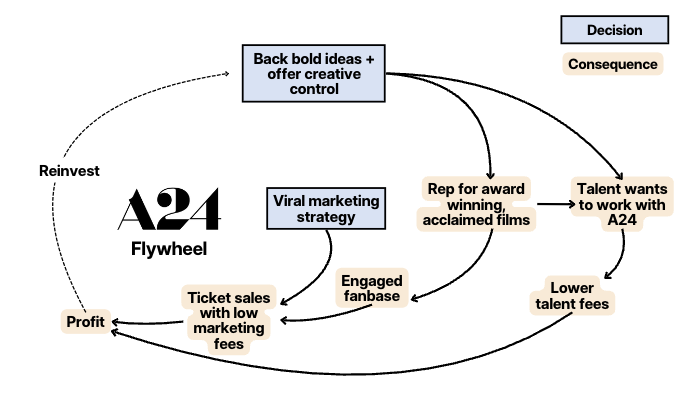

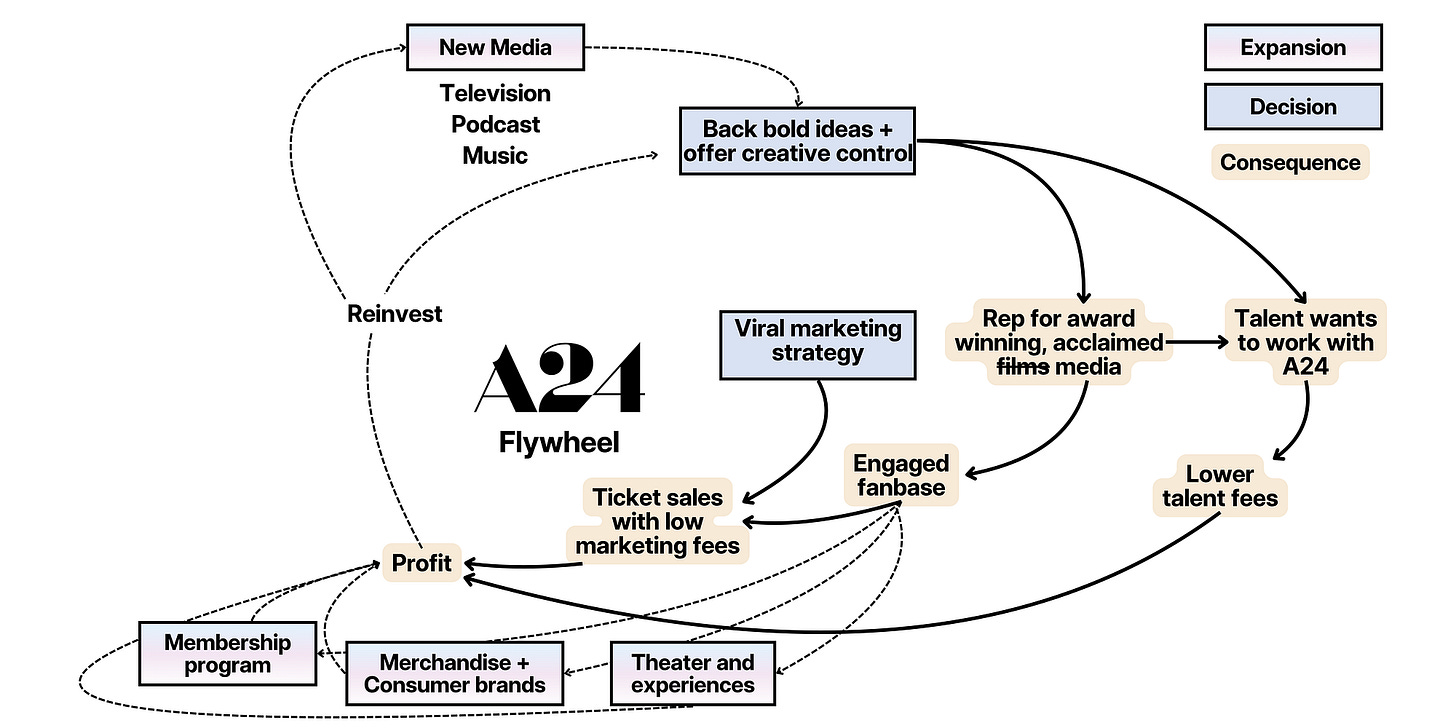

With consistent viral marketing and lower cost talent, A24 has built out a flywheel business model that drives increasing engagement and a flow of talent to the studio:

Step 2 of building a platform brand: Define your core values

A24’s indie film flywheel is a great business. But it’s not a $3.5 billion business. A24’s growth plan depends on their ability to scale ‘auteur films’ to new business lines.

Brands that expand this way do so by applying a consistent set of values to expansions, ensuring all products convey the same point of view. Apple applies its values of minimalist design and premium user experience to all of its products. Similarly, if you know A24 films, you have an idea what an A24 restaurant would be like (experiential, unexpected, chef-led), even if one does not (yet) exist.

A24’s values include:

Creative freedom: A24 gives its talent almost unprecedented creative freedom to create great work, which has resulted both in the production of distinct films and an inflow of talent who want to work with A24.

Cultural impact: A24 was founded on the premise of backing films ‘from a distinctive point of view,’ and the team has continuously brought atypical stories into the limelight.

Break with convention: As seen from A24’s marketing, development, and creative output, the A24 team likes to think outside of the box. This means that as A24 expands, say to movie theaters, they wouldn’t launch a typical theater. It would be an A24 theater.

With these values in mind, the A24 team can expand while also maintaining A24's potency and consistency.

Step 3 of building a platform brand: Expand into new products with values in mind

A24’s is already charting a route to a $3.5 billion valuation by platforming its brand— with additional business lines including TV, music, merchandise, subscriptions, new experiences, and new brands altogether.

Television:

A24 launched its TV division in 2015, and its television creds now rival its movie acclaim, with HBO’s Euphoria, Hulu’s Ramy, and Netflix’s Beef under the A24 TV umbrella. TV deals provide a stable source of income to balance out A24’s film bets, and get the A24 brand in front of new audiences.

A24 also partners directly with streaming services for distribution (A24 has signed with DirecTV, Showtime, Warner Brothers to distribute films) and production (A24 partnered with AppleTV (2018) and United Talent Agency’s Civic Center media (2024) to produce original content).

Podcast:

Like their films and TV shows, The A24 Podcast is known for its unique format that puts filmmakers at the center. The podcast has no set host, no ads, and according to the description, ‘no rules.’ It focuses on candid conversations between creatives from A24’s film and TV projects — serving as another touchpoint for the brand’s values, and a potential avenue for paid content and amplification of A24’s various content franchises.

Music:

On April 25, the company teased a music division, with a cryptic social media post that just said ‘A24 music.’

Membership:

An interesting part of A24’s expansion is its move into non-media businesses. Such as a members club. A24 membership costs $99 annually and includes tickets to all A24 film releases, plus a regular magazine, merchandise discounts, a birthday gift, and exclusive content. This year, A24 hired a new Head of Memberships to run this program — indicating a plan for expansion. For A24’s super fans, the subscription is another way to engage with the brand. For A24 investors, it’s a source of recurring revenue — which tends to carry a high multiple.

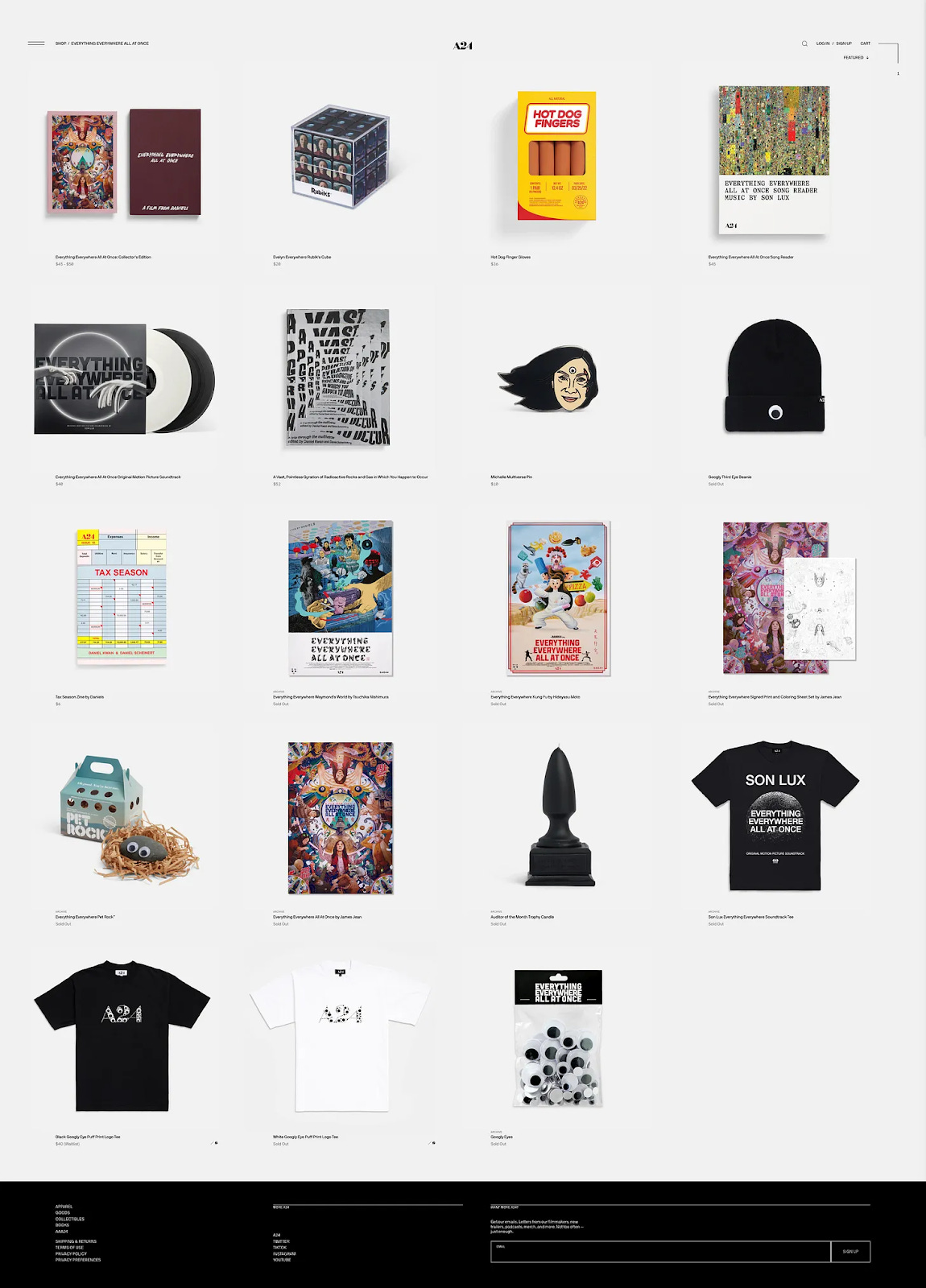

Merchandise:

A24 has an online merchandise business selling branded clothing and accessories as well as merchandise for each of its film and TV franchises. How big can a branded merchandise business really get? Disney’s Consumer Products segment is on pace for roughly $3.8 to $4 billion in revenue in fiscal 2025. (Source: CNBC).

A24’s core of genre blending films and unique characters provide an easy route to further commercialize each release with film-specific merchandise, and could be a launchpad for other film-related media like video games, books, and experiences.

Consumer Brands:

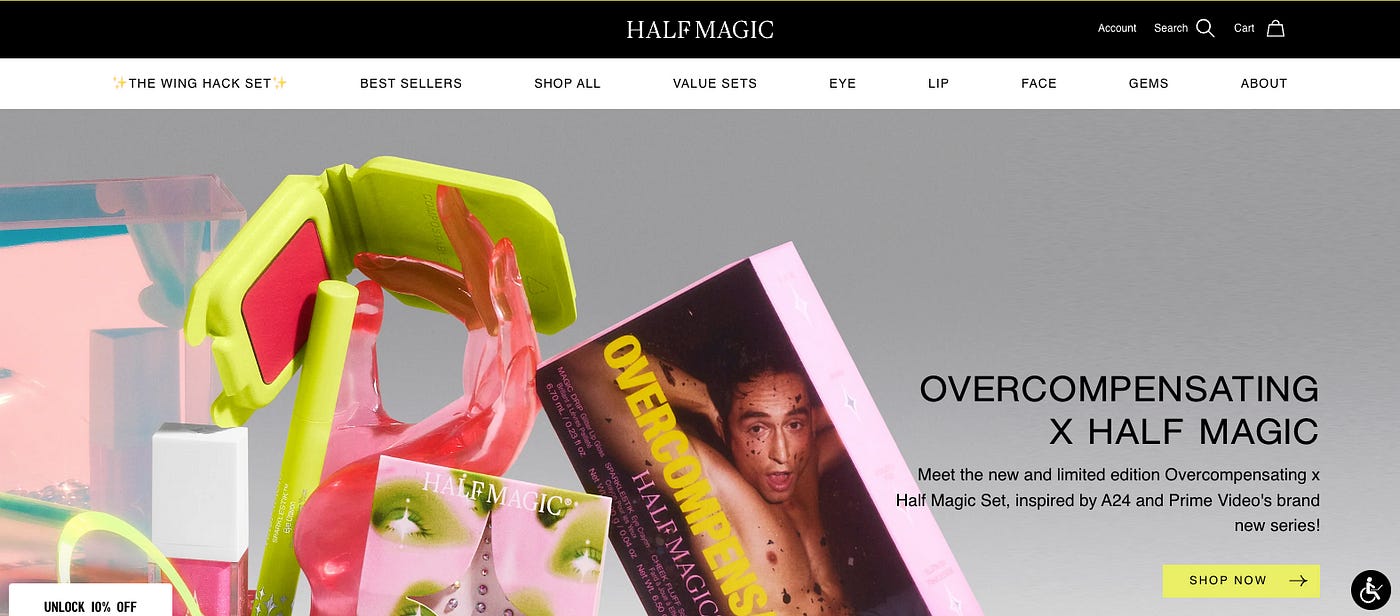

A24 is pushing beyond branded merchandise, and launching full-fledged consumer brands. In 2022, A24 launched Half Magic Beauty, a makeup line inspired by the sparkly, expressive looks from Euphoria in collaboration with Euphoria’s makeup artist Donni Davy. A24 hired marketers from beauty brands Tatcha and True Botanicals to market the line — signaling that Half Magic isn’t just a merch campaign for Euphoria. It’s a standalone consumer brand. If you’re curious, Tatcha was Acquired by Unilever for $500 million.

The Half Magic team has already moved beyond Euphoria, and is activating other parts of A24’s content library for collaborations. Earlier this year, A24 launched a makeup kit with A24’s Prime Video show Overcompensating.

Marketing is the biggest line item for cosmetics brands. As A24 launches more shows, the Half Magic team can leverage these properties for free media. Magic indeed.

Launching a fashion brand could be next for A24; the studio already sells clothing. What’s in the way of launching a standout line that can then be shown across A24 content? Or a food brand? Or alcohol?

Experiences:

In 2023, A24 took over the lease of Cherry Lane theater in New York City. The purchase includes two theaters and 8 apartments, and will likely offer fans new ways to engage with A24. According to the New York Times, live performances are on the table, presenting another media avenue altogether.

When you put it all together, A24 is no longer an indie studio for arthouse films. It’s not a blockbuster machine, either. Instead, A24 is doubling down on what the company has always been about: unique, standout storytelling, and turning that into a diversified business by expanding into new arenas and using creative marketing to go viral.

What’s next?

Potentially A24 transforms their membership program into its own streaming service. Or expands Cherry Lane into a chain of movie theaters. Or, A24 launches a wave of consumer brands via collaborations with its growing library of content.

The investors behind A24’s $3.5 billion valuation could help with consumer brands. Growth Equity firm Stripes holds investments in Reformation (fashion/apparel), Levain bakery (baked goods), and On Running (athletic footwear/apparel), while Thrive Capital has invested in Glossier (cosmetics), Warby Parker (eyewear), Harry’s (men’s grooming), Away (travel goods), among other consumer brands.

Considering all the potential expansions for A24, the $3.5 billion valuation might not be so far fetched.

Platforming as a growth strategy — How can other brands achieve it?

A24 is hardly the first brand to opt for expansion via platform. Disney, Apple, Lego, the Dallas Cowboys, Muji, Nike, Formula1, Patagonia have all managed to expand their original business across consumer products, media, and experiences.

One enabler is a distinct point of view. In other words — your values. The point of view is what allows your brand to enter new categories and offer something unique on the market (I want to know what a Nike gym is like) while also leaning on the audience you have already built to be the first audience for new expansions. A24 can leverage their fanbase to come to its theater or try its consumer brands, increasing the likelihood of success.

Maintaining distinctiveness is not easy. It’s common for companies to dilute their brand to attract new audiences as they scale. Instead of going wide, platform brands like A24 focus first on going deep — creating multiple products to turn their existing fandom into multiple revenue streams. With this depth eventually comes broader audiences. Ideally, platform brands manage to hold onto their values as their audience grows.

“I could see [A24] saying, like: ‘We’ve got a reputation now, and have money now.’ A lot of people in that position would then go, ‘Okay, let’s become quite conservative in our choices.’ And what’s lovely is they are choosing to still channel that stuff back into supporting weird, different, ambitious ventures.” Daniel Radcliffe,

To that end, a second enabler of platforming is knowing your customer. Platform brands focus on creating ways to offer more to current customers (i.e. merchandise, podcast), which requires a deep understanding of who they are and what they look to you for.

Finally — owners of platform brands consider synergies across their business lines. In other words, they build a flywheel. A24’s TV shows advertise their consumer brands (Euphoria and Overcompensating + Half Magic) while pulling new audiences into the A24 film universe, which turns into membership revenue and podcast listeners. Avid film fans will line up for A24’s eventual theater, and A24’s membership platform will enhance A24’s targeted marketing efforts across business lines. A24’s future streaming service has an easy path to launch with a built-in membership audience.

With A24’s new expansions in mind, A24 now has multiple flywheels — reinforcing its standout brand, and driving an increasing level of revenue worthy of a multi-billion valuation.

What do you think of the platform business model? And the future of A24?

Insightful. I loved it

This post is a true gem.